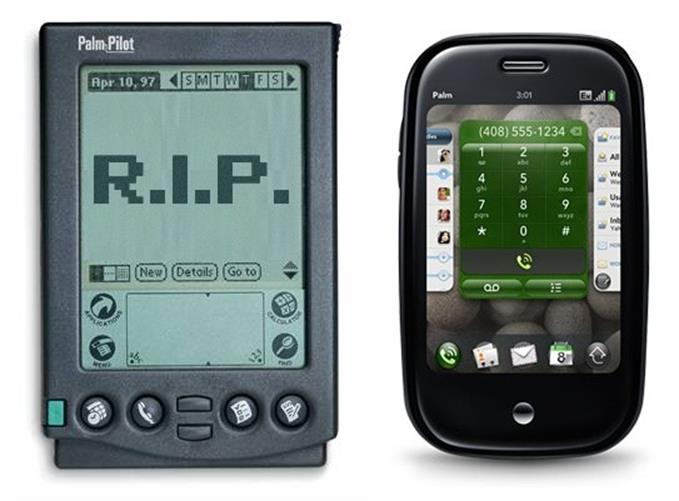

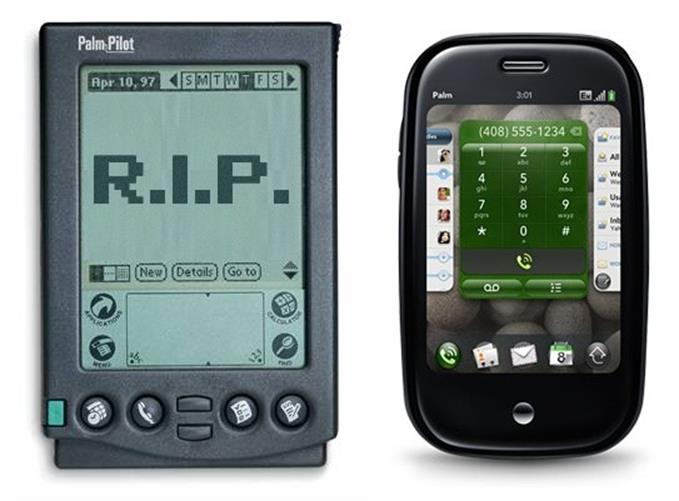

The rapid downfall of Palm showed just how ruthless the battle between Microsoft’s, Google’s, and Apple’s ecosystems has become, as RIM is currently finding out. But what happened? How did the company meet its demise so quickly? After extensive research, and numerous interviews Chris Ziegler pieced together the story of the final years of Palm. It’s long, detailed, and well-written. If you’re interested in the mobile wars we encourage you to read it here. But some highlights include:

- In CES 2009 Palm looked set to enter the market and transform the smartphone wars. 31 months later it became a faceless subsidiary of a faltering company without a clear future ahead of it.

- The problem starts with the success of Palm’s own mobile operating system, which dominated most of the 90s. As with any established software ecosystem it was difficult to break from the past and create a modern software platform that is caught up with the times.

- Palm finally made a serious attempt to develop a new operating system in 2007 – after the iPhone had been released – but before it met with its genre defining success.

- However by 2008 it was clear that the new software being developed was junk and too difficult to use.

- Two executives had an innovative idea to develop an entirely separate operating system based on existing technologies created by other companies.

- However there was internal fighting between the two visions for the future of Palm.

- At the end of the day the new idea was successful and was debuted at CES 2009 with extremely positive critical reception. Behind the scenes though the company was in crisis. It had promised to deliver the phones by mid-2009, but Palm essentially had to start all over again with its software development.

- When the phones were released, a small carrier, bad advertising, and a bug-ridden OS ensured that sales disappointed.

- Palm realized it needed a buyer and an investor. HP stepped up to the plate and bought it for $1.2 billion. However internal strife at HP meant that the company soon lost interest in its acquisition.

- Meg Whitman the current CEO of HP claims to have high hopes for it, but there are reasons to believe that she will drop it after July 1st. All of the senior members of the original Palm team have left anyway.

Again if this is your kind of thing you have no idea just the kind of details you’re missing. Read about how Steve Jobs was so afraid of Palm’s initiative that he tried to strike an illegal deal, or how Palm was betrayed repeatedly by Verizon, some choice quotes, why people started erecting curtains around their desks, the role that bake-offs played, how Palm was like a startup, why Meg Whitman was honest, the thousand dollar dinner that could easily be justified, and a comprehensive video library in addition to much more over here.

Source: The Verge

Join the Discussion! (No Signup Required)