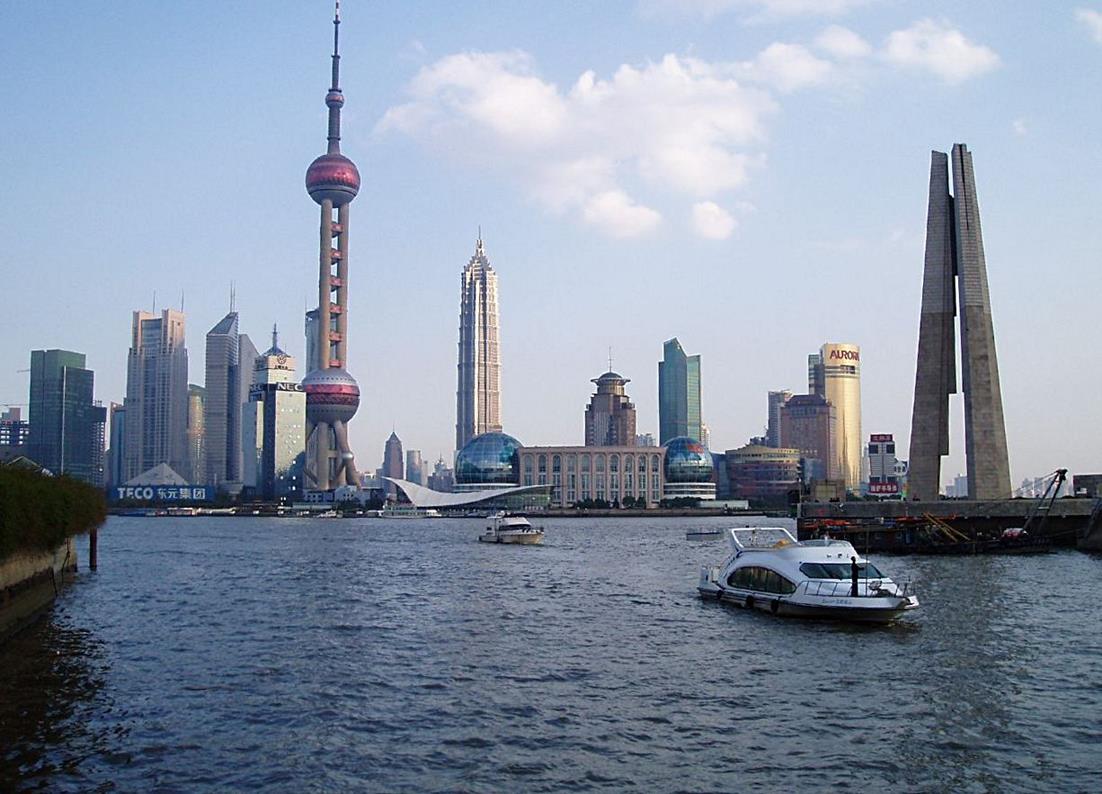

Will Emerging Markets Ultimately Stay Submerged?

July 12, 2012 in Daily Bulletin

Antoine van Agtmael first coined the term ’emerging markets’ and for most of the past decade people have believed that they were the future. The tide, however, is now turning, he writes, and it looks like the United States may stay on top after all. There are five reasons why:

- Shale Gas. The United States has lots of it and is able to both use and export it.

- The erosion of low-cost advantage. Manufacturers shifted to India and China because of the cost savings. But wages have risen there while they stagnated in the US. Corporations can now consider manufacturing in the US.

- Ageing populations. China with its one child policy is ageing fast. America with its open immigration policy is not.

- Smartphones. China has done a bad job of encouraging the spread of smartphones while America has excelled at it, and they’re becoming increasingly important.

- Smarter competition. Companies like Caterpillar, Amazon, and Facebook have not taken the rise of China sitting down. They’ve evolved and adapted.

The comprehensive three page article written by a man who first predicted the rise of emerging markets – and now is predicting their relative demise, can be found here, where you can also read expanded bullet points about why each of these five things is giving America the advantage, and what the view looks like from emerging markets.

Source: Foreign Policy

Join the Discussion! (No Signup Required)